POST COVID-19 CRISIS - IMPACT & SUGGESTIONS FOR BUSINESS IMPROVISATION

CMA Rajendra Rathi

Wishing a very good health to all. Currently we all are passing

through a very critical time which presently requires

us to stay at home and follow

the Government Guidelines to prevent ourselves

and avoid spread of CORONA VIRUS in the Society.

This is a worldwide pandemic and all the countries entered in to an

unprecedented crisis. India is looking towards safety of citizen as the first

priority followed by economic safety of the future. It is hoped that post

Covid-19 crisis, INDIA will bounce back with strong business platform and

become as the Best investment place for foreign investors too with a boost to

the growth engine of the world.

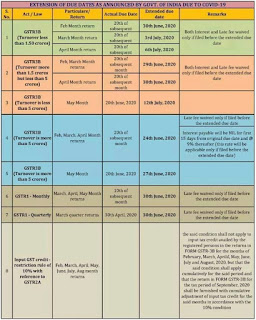

While safe-guarding the life of citizens through Lock-down the

Government has also initiated some of GST relaxations in regard to payment of

tax, filing of Returns etc. with a view to recover the health of the business.

v Few important recent GST amendment can be understood in line with the above.

Notification

No. 30/2020 – Central Tax dated 03.04.2020 has been issued relaxing the time

limit up to 30.06.2020 for opting Composition Scheme in the year 2020-21

Notification

No. 31/2020 – Central Tax dated 03.04.2020 has been issued lowering the rate of

interest for delay in filing GSTR-3B Returns.

Notification

No.32/2020 – Central Tax dated 03.04.2020 waives the late fee for the delay in

filing GSTR-3B Returns of March & April, 2020 up to 30.06.2020.

Notification

No.33/2020 – Central Tax dated 03.04.2020 waives the late fee for the delay in

filing GSTR-1 Returns of March & April, 2020 up to 30.06.2020

Notification No.34/2020 – Central Tax dated 03.04.2020 relaxes Composition Dealer Quarterly

Return GST-CMP-08 ending March, 2020 up to 07.07.2020 : Also GSTR-4 Return for

the F/Y 2019-20 up to 30.06.2020.

Notification No.35/2020 – Central Tax dated 03.04.2020 relaxes

various due date compliance to be made between 20.03.2020 and 29.06.2020 up to

30.06.2020.

Section 16(2) falls under Chapter V of CGST Act.

Exception carved out in the notification does not cover chapter V -

only chapter IV pertaining to time of supply is in exclusion. It looks the Government

purposefully not disturbed this time of supply as

it may lead to complexity in deciding supply and its taxability.

Hence, as per my understanding, this extension is applicable to

16(2) compliance as well. Accordingly 180 days coming between specified periods

will extend to 30th June 2020. Refer attached clarification dated 13.04.2020

also support our views.

While

making the payment to recipient, amount equivalent to one per cent was

deducted as per the provisions of section 51 of Central Goods and Services

Tax Act, 2017 i. e. Tax Deducted at

Source (TDS). Whether the date of deposit of such payment has also

been extended vide notification N. 35/2020-Central

Tax dated 03.04.2020?

|

As per notification No. 35/2020-Central Tax dated 03.04.2020, where the timeline

for any compliance required as per sub-section

(3) of section 39 and

section 51 of the Central Goods and Services Tax Act, 2017 falls during the

period from 20.03.2020 to 29.06.2020, the same has been extended till

30.06.2020. Accordingly, the due date for furnishing of return in FORM GSTR-7 along with deposit of tax

deducted for the said period has also been extended till 30.06.2020 and no

interest under section 50 shall be leviable if tax deducted is deposited by 30.06.2020.

|

Further

matching clause also relaxed so CMA can advise all their clients to file

refund on inverted duty structure immediately using online facility so same

will be received immediately to them

which will help them

to improve their

cash flow during

this tough time.

|

|

Now we CMA can utilize this time to make possible value additions by

giving business improvisation /optimization suggestions through our institute

to Governmment as well as to Business, so as to socio economic growth can be

maintained with healthy life.

This can be achieved by three level actions plan.

v Suggestion at Govt. level.

Govt. can plan to bring following policies

as a measure of job safety and ease of doing business and an initiative in Digital

India environment:

(a)

Direct all the Businesses not

to lay off or remove the employees.

(b)

Support Businesses in a

possible manner as demonstrated by the Government in paying Provident Fund for

the period March, 2020 to May, 2020/

(c)

Rural socio-economic zone can

be developed in each district at village level/rural area level Especially for

labor-oriented industries in nearby area where labours are available

(d) Skill development center’s with IT facilities providing certificate

can be started at each town level as post COVID-19

requirement of skill

labor will increase

and job opportunities can be improved to skilled

man power.

(e)

All Govt. schemes can be

monitored by Robust system reports.

(f)

New education policy covering

health care, yoga and online/digital model at affordable cost making cost audit

and cost record mandatory in education services.

v Suggestion at Institute level

CMA Institute

can plan to help nation in achieving 5 trillion-dollar economy.

CMA

institute can develop format for optimization of business model for various

sector like:

·

Educate public to spend only for necessary livelihood

and to avoid luxury needs. To this a

matrix to be drawn Dos

and Don’ts for the next one year.

·

To conduct Seminars/Conference

only through video conferencing for the next one year

·

Automobile industry can think

about leasing model

·

Airline can convert passenger

plane into Cargo Plane for 6 months.

·

Textile can produce Apron for

health care institutions

·

Education system with online facility

·

Yoga and alternative therapy

facilities for mass at optimum cost with organic food

·

Labor can get become skilled by

having basis awareness about computer

CMA institute can publish back ground material on major sector like

infrastructure, automobile, health care, education, Banking, Agriculture as

well as on GST, Digital India, and import export.

v Suggestion at Members level.

(a) All CMA members to acquire proficiency in cost effectiveness model

for business to improve their efficiency and

profit.

(b)

New innovative, business to

business (B2B) platform can be developed for multipurpose solutions like

procurement and logistic optimization.

(c) Robust Audit tool for GST audit to make client 100% complied

(d)

Standard operating procedures

(SOP) to be developed for all major activities like GST Audit, Internal Audit etc.

Now we CMA have a challenge to prove ourselves as doctor for economy

booster in present crisis. We can contribute as Digital CMA in improving ease of doing business with optimization

of men, machine, money and health following social distancing till the time the

pandemic is completely eradicated.

Hope under inspiring leadership of president our institute will

create situational leaders at all over India in practice as well as in industry

to feel our profession presence to all stakeholder including rural area. Jai

CMA

Comments

Post a Comment