FM Announcement amid Corona Virus Lockdown

*Income Tax Related Matters*

1.FY 18-19 Income Return Filing is extended to 30.06.2020. Interest for late payment shall be 9% on tax payment

2. No extension for TDS Payment and interest on delay of TDS payment will be 9% instead of 18%.

3.Notice filing and Compliance extended to 30.06.2020

4.Adhar pan Linking Date extended to 30.06.2020

5.Vivad Se avishwas Scheme extended to 30.06.2020, only 100% tax payment required if payment is made before 30.06.2020

6.Issue of Notice for Intimation and other Statutory Compliance’s related to Litigation and Return Filing by the Tax Payer shall be complied by 30.06.2020. Same is extended for Appeal filing at Various Levels. Taxpayer now will have time to submit the Compliance’s for the Various notices issued by Income Tax Departments.

7.Capital Gain Investment and Investment in Tax Saving extended till 30th June 2020.

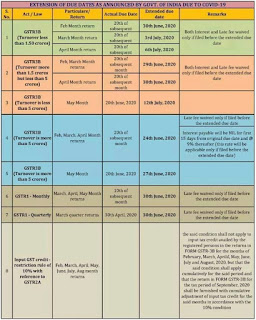

*GST*

1.Last date for filing gst returns for March, April and May and Composition returns extended to 30th June 2020.(Specific regions will be notified)

2. Companies less than 5 crores turnover, no interest, late fees or penalty

3. Bigger companies i.e greater than 5 crores only interest but not penalty or late fees

4. Date for opting composition scheme extended to 30th June 2020

*Companies Act 2013 Compliance*

1. In respect of MCA21 registry, moratorium from 1st April to 30th September

2. For holding board meetings, relaxation for a period of 60 days and this relaxation is till the next two quarters.

3. CARO 2020 is applicable for financial year 2020-21.

4. For the year 2019-20, if no meetings of independent directors are done, it is not a violation in Companies Act 2013

5.Commencement of business for newly incorporated company extended by 6 more months

6.If Company director does not comply with minimum requirements in india, for 182 days or more. U/s 149 it may not be treated as violation

7.provisions of 20% on deposit reserve extended

8. To invest 15% of debentures maturing extended to 2020 June

*Insolvency and Bankruptcy Code*

1.The threshold for default is raised from Rs. 1 lakh to ₹1 crore, to prevent IBC for msme

2. Section 7, section 9 and section 10 of IBC to be suspended if situation detioriates beyond 30th April

*Banking and financial services*

1. Debit cardholders withdrawing cash is free of charge, no banking charges for next three months

2. No minimum balance charges till 30th June

3. Reduced bank charges for digital trade transactions for all trade finance consumers

Comments

Post a Comment