ADDITIONAL RESTRICTION ON ITC (BLOCK CREDIT)

Introduction

GST was introduced to remove

cascading effect of taxes however, with the advent of new tax regime new frauds

were emerging such as taking input tax credit against fake invoices or invoices

without receipt of goods or services. According to sources, GST officials

recently bust fake invoicing racket worth rupees 7896 crore in Delhi, where

companies procured and generated invoices without actual supply of goods and

avail as well as passed on input tax credit. Keeping in mind the amount of loss

to the Government treasury, Government introduced new rules Rule 86A.

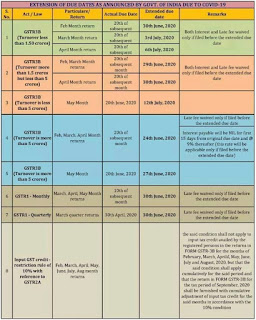

For simplicity, I have apprehended all measures

taken by government along with relevant circular for reference regarding blocking

of input tax credit:

Notification No /

|

Description

|

|||

Circular / Section

|

||||

49/2019 CT Dated 09-

|

Insertion of new rule 36(4) To

restrict ITC after matching (Maximum up to 120%

|

|||

Oct-2019

|

of eligible amount / 110% of

eligible amount W.E.F 1-1-2020

|

|||

Circular 123 Dated 11-

|

Restriction of 36(4) will be

applicable only on the invoices / debit notes on which

|

|||

Nov-2019

|

credit availed after 09.10.2019.

|

|||

New rule 86(A) inserted

|

||||

According to this rule The

Commissioner or any other officer not below the rank

|

||||

of Assistant Commissioner

authorized by him can restrict the ITC after having

|

||||

reasons to believe that credit of input tax available in the electronic

credit ledger

|

||||

has been fraudulently availed or

is ineligible:-

|

||||

75/2019 CT Dated

|

1.

|

if the input credit has been

availed and the prescribed documents are not

|

||

in possession of the tax

payer or

|

||||

26.12.2019

|

||||

2. the if the due tax has not paid

by the supplier or

|

||||

3. if the goods or services has

actually not been received or

|

||||

4.

|

if the supplier is not in

existence from the place it had taken registration

|

|||

etc.

|

||||

However, Such restriction shall

cease to have effect after the expiry of a period of

|

||||

one year from the date of imposing

such restriction.

|

||||

Blocking of ITC under rule

86(1)(a)

|

||||

1. Empowerà The CGST Officer to block ITC under certain circumstances.

|

||||

2. Facility: à All zonal chief commissioner have facility to

block/unblock

|

||||

ITC availed in a situation covered

under rule 86(A)(1)(A)of the CGST

|

||||

DGCI letter 587 Dated

|

Rules 2017 i.e. against fake

invoices or against invoices without receipts

|

|||

of goods or services or Both.

|

||||

13.o1.2020

|

||||

3.

|

Operationalize :à

|

|||

(a) each Pr. Chief commissioner

should appoint an officer of the rank od

|

||||

deputy commissioner /A.C , as a

nodel officer , assisted by few more

|

||||

officers who should undertake this

activity

|

||||

(b) Will submit daily report as

per format to Pr DG DGCI HQ.

|

||||

CBIC unveils new app for exchange

of information between Centre & State

|

||||

CBIC Tweet dated 07-

|

CBIC (Directorate of Data

Management) launches an application for sharing

|

|||

information between Centre and

State for targeted enforcement action against GST

|

||||

02-2020

|

||||

evasion; Terms is as a big leap in

intelligence sharing and cooperative federalism:

|

||||

CBIC

|

||||

SOP to be followed by Exporter

|

||||

1. Several cases of monetisation

of credit fraudulently obtained or ineligible credit

|

||||

through refund of Integrated Goods

& Service Tax (IGST) on exports of goods

|

||||

have been detected in past few

months.

|

||||

On verification, several such

exporters were found to be non-existent in a number

|

||||

Circular 131 dated

|

of cases.

|

|||

23.01.2020

|

In all these cases it has been

found that the Input Tax Credit (ITC) was taken by

|

|||

the exporters on the basis of fake

invoices and IGST on exports was paid using

|

||||

such ITC.

|

||||

2.To mitigate the risk, the Board

has taken measures to apply stringent risk

|

||||

parameters-based checks

driven by rigorous data analytics and Artificial

|

||||

Intelligence tools based on which certain exporters

are taken up for further verification.

Overall, in a broader time frame the

percentage of such exporters selected for verification is a small fraction of

the total number of exporters claiming refunds. The refund scrolls in such

cases are kept in abeyance until the verification report in respect of such

cases is received from the field formations.

Further, the export

consignments/shipments of concerned exporters are subjected to 100 %

examination at the customs port.

|

||||

Rule 86A as introduced runs as under:

Rule 86A. Conditions of use of amount

available in electronic credit ledger-

(1) The Commissioner or an officer authorised

by him in this behalf, not below the rank of an Assistant Commissioner, having

reasons to believe that credit of input tax available in the electronic credit

ledger has been fraudulently availed or is ineligible in as much as:

a) the credit of input tax has been availed on

the strength of tax invoices or debit notes or any other document prescribed

under rule 36-

i. issued by a registered person who has

been found non-existent or not to be conducting any business from any place for

which registration has been obtained; or

ii. without receipt of goods or services

or both; or

b) the credit of input tax has been availed on

the strength of tax invoices or debit notes or any other document prescribed

under rule 36 in respect of any supply, the tax charged in respect of which has

not been paid to the Government; or

c) the registered person availing the credit of

input tax has been found non-existent or not to be conducting any business from

any place for which registration has been obtained; or

d) the registered person availing any credit of

input tax is not in possession of a tax invoice or debit note or any other

document prescribed under rule 36,

may, for reasons to be recorded in writing, not

allow debit of an amount equivalent to such credit in electronic credit ledger

for discharge of any liability under section 49 or for claim of any refund of

any unutilised amount.”

(2) The Commissioner, or the officer

authorised by him under sub-rule (1) may, upon being satisfied that conditions

for disallowing debit of electronic credit ledger as above, no longer exist,

allow such debit.

(3) Such restriction shall cease to

have effect after the expiry of a period of one year from the date of imposing

such restriction.

From the above rule it is clear that before

power under Rule 86A is exercised there must be a reason to believe that credit

of input tax available in the electronic credit ledger has been fraudulently

availed or is ineligible qua the following reasons:

1. Supplier/Recipient found non-existent or not

conducting business on its registered place: It has been availed on the basis of documents

prescribed under Rule 36 i.e. tax invoice, debit note etc issued by a

registered supplier who has been found non-existent or not to be conducting any

business from any place for which registration has been obtained.

2. Non receipt of goods or services or both: It has been availed on the

basis of documents prescribed under Rule 36 i.e. tax invoice, debit note etc

without receipt of goods or services or both.

3. Tax not paid into the Government treasury: It has been availed on the

basis of documents prescribed against which no tax has been paid into the

Government treasury.

4. Availing of credit without documents: The registered person availing any

credit of input tax is not in possession of a tax invoice or debit note or any

other document prescribed under rule 36.

It would be interesting to see whether the

mechanism of blocking of credit (as is currently done on the common portal by

the Department) is adopted for exercising the power under Rule 86A

or some other mechanism is worked out.

The restriction in the Rule 86(A) though seems

to be temporary but is drastic as it can be used if there is a reason to

believe as to the grounds stated above and a final finding is not required as

to eligibility or ineligibility of the credit.

However,

before exercising this power reasons must be recorded in writing. Hopefully the

drastic powers in the rule are exercised sparingly and not used as a

routine matter in every case.

The Directorate General of GST Intelligence (DGGI)

directs to Block disputed Input Tax Credit against Fake Invoices, Invoices

without Receipt of Goods or Services and has issued directions to all Zonal

Chief Commissioners on Blocking of Input Tax Credit under rule 86A(1)(a) of

CGST Rules.

In a Communication issued to all Principal

Commissioners of the State Department, the DGGI also directed that, all over

India, should also make a Cell in their zone head office nominating one AD/DD

rank officer as nodal officer assisted by a few other officers to block the

credit of such avails received from their zonal CGST Chief Commissioner, who

are located outside the jurisdiction of the concerned CGST Zone.

UPDATES

Ø

CBIC through Tweet dated 07- 02-2020 unveils new

app for exchange of information between Centre & State CBIC (Directorate

of Data Management) launches an application for sharing information between

Centre and State for targeted enforcement action against GST evasion; Terms is

as a big leap in intelligence sharing and cooperative federalism

Ø Recently

SOP to be followed by Exporter has been introduced through circular 131 dated

23.01.2020:

1.

Several cases of monetization of credit

fraudulently obtained or ineligible credit through refund of Integrated Goods

& Service Tax (IGST) on exports of goods have been detected in past few

months. On verification, several such exporters were found to be non-existent

in a number of cases. In all these cases it has been found that the Input Tax

Credit (ITC) was taken by the exporters on the basis of fake invoices and IGST

on exports was paid using such ITC.

2.

To mitigate the risk, the Board has taken

measures to apply stringent risk parameters-based checks driven by rigorous

data analytics and Artificial Intelligence tools based on which certain

exporters are taken up for further verification. Overall, in a broader time

frame the percentage of such exporters selected for verification is a small

fraction of the total number of exporters claiming refunds. The refund scrolls

in such cases are kept in abeyance until the verification report in respect of

such cases is received from the field formations. Further, the export

consignments/shipments of concerned exporters are subjected to 100 %

examination at the customs port.

Conclusion

From above it can be concluded

that Govt. is very strict about GST compliance and made retrospective amendment

to levy equal penalty for ITC on fake invoices in this budget. Further

presently huge amount of ITC as well as GST refund is under hold for

verification because of such ITC.

Now CBIC launches application for

sharing information between Centre and state for targeted enforcement action

against GST evasion. Accordingly, all assessee need to ensure strict discipline

in selection of supplier with proper due diligence before executing any

transaction otherwise it may create trouble in future. Moreover, purchase

condition can be modified by inserting appropriate payment clause after

matching only.

From above it can be concluded

that every client should keep their system as per GST compliance requirement and

keep the business relation with 100% GST complied supplier to avoid such

additional restriction like blockage of ITC, Blockage of e way bill etc. Govt.

action are in right direction for such targeted defaulters by introducing

measures to apply stringent risk parameters-based checks, driven by rigorous

data analytics’, artificial intelligence tool to taken up further verification.

The Institute of the Chartered Accountants of India can become system partner

in development of system base Audit tool in saving leakage of revenue by undue

means and smooth compliance timely. Business long-term survival with peace will

be based on 100% GST compliance on real-time basis and CA can help in

optimization by keeping updated knowledge on GST as well as system

Comments

Post a Comment