39th GST COUNCIL MEETING UPDATES:

The GST Council defers the proposal on the taxability of economic surplus of brand owners of alcohol for human consumption.

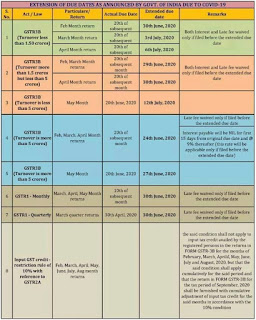

Important announcement: GSTR-9 and 9C due date pushed to 30th June 2020 for FY 2018-19 from 31 March 2020; Increases the turnover limit from Rs 2 cr to Rs 5 cr for the mandatory annual return filing.

The GST rate on mobile phones will be increased from 12% to 18% allowing a full claim of input tax credit;

Relief given to domestic service providers of maintenance, repair and operations. More details awaited.

GST rate rationalisation postponed to the next meeting to be held in April 2020, details of which are awaited.

GST Council to announce the e-way bill-FASTag integration to be applicable from April 2020.

Union FM likely to defer the issue of the states’ compensation to the next meeting in April 2020.

Infosys asks for a year’s time to build smooth functioning GST’s IT systems by January 2021; Infosys Chairman Nandan Nilekani to be part of next three GST Council meetings.

Comments

Post a Comment